When starting a business, choosing the right structure is a major decision. A corporation might seem appealing with its promise of protecting personal assets and offering easy ways to raise money. However, it comes with challenges, including strict regulations and possible double taxation.

Learning more about the benefits and downsides of incorporating helps in deciding if this structure suits your business goals.

This guide offers insights into whether a corporation is the best fit for your business plans.

Benefits of Running a Business as a Corporation

| Benefit | Description |

|---|---|

| Limited Liability Protection | Owners’ personal assets are protected from business debts and liabilities. |

| Access to Capital | Corporations can raise funds through the sale of stock. |

| Business Continuity | The corporation continues to exist even if ownership changes. |

| Credibility and Professionalism | Having a corporate structure enhances the business’s image and credibility. |

| Tax Advantages | Certain tax benefits are available, such as avoiding self-employment taxes. |

1. Limited Liability Protection

One of the primary reasons many entrepreneurs opt for a corporation is the protection it offers to personal assets. In a corporate structure, the business is treated as a separate legal entity, meaning that the owners, or shareholders, are not personally liable for the debts and obligations of the business.

For example, if a corporation faces a lawsuit or goes bankrupt, only the assets owned by the corporation are at risk. The personal assets of shareholders, such as their homes, cars, and personal savings, remain protected.

This is a stark contrast to sole proprietorships or general partnerships, where personal assets can be seized to cover business debts.

In the case of Enron Corporation, a major U.S. energy company, when the company went bankrupt in 2001, the shareholders lost the value of their stock, but their personal assets were not at risk due to the corporate structure.

The limited liability protection ensured that only the company’s assets were used to settle debts, not the personal assets of those who owned shares in the company.

Such protection, however, requires strict adherence to corporate formalities and regulations. Failure to maintain these can lead to a court “piercing the corporate veil,” where the protection is removed, and personal assets are exposed to liability.

Legal Insight

According to legal experts, the key to maintaining this liability protection is to keep corporate finances separate from personal finances, maintain proper records, and ensure that the corporation adheres to all regulatory requirements, including holding annual meetings and maintaining bylaws.

2. Access to Capital

One of the most significant advantages of forming a corporation is the enhanced ability to raise capital. Corporations can issue stocks, making it easier to attract investors and secure funds needed for expansion, research, and development, or other critical business activities.

In the second quarter of 2024, the U.S. IPO market showed signs of recovery, with industrial manufacturers leading the charge. This sector alone brought 17 new listings to market, raising a combined $2.25 billion.

Such access to capital allows these companies to invest in new technologies, expand their operations, and compete more effectively in the global market.

Another clear example is the mid-market firms, which despite facing higher interest rates and stricter lending conditions, are still managing to secure necessary funds.

3. Business Continuity

One of the standout advantages of forming a corporation is the inherent business continuity it provides. Unlike other business structures, a corporation exists independently of its owners.

This means that the corporation can continue to operate regardless of changes in ownership, such as the sale of shares or the death of a shareholder. This continuity is vital for businesses aiming for long-term stability and growth.

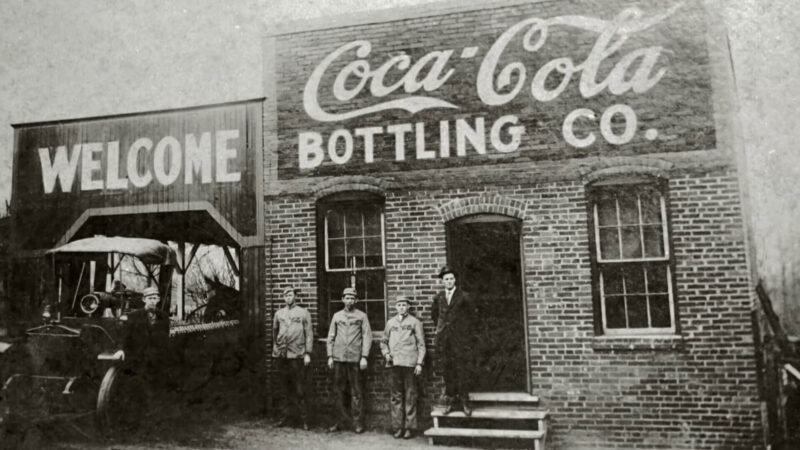

Consider large corporations like Coca-Cola or IBM. These companies have existed for over a century, with countless changes in leadership, ownership, and market conditions.

Despite these changes, they have continued to thrive, largely due to the corporate structure that allows for seamless transitions in ownership and management.

In practice, this means that a corporation can sign long-term contracts, plan multi-year projects, and build lasting relationships with stakeholders without the uncertainty that comes with sole proprietorships or partnerships, where the business might dissolve if an owner exits.

Moreover, the corporation’s ability to outlast its founders ensures that the brand, mission, and legacy can continue indefinitely, potentially growing stronger with each generation of leadership.

This business continuity is a significant factor for entrepreneurs looking to build something enduring, with the potential for a legacy that can be passed on or even taken public through an IPO, as seen with companies like Amazon and Google.

4. Credibility and Professionalism

Forming a corporation often enhances a company’s credibility and professionalism in the eyes of clients, investors, and the public. The “Inc.” or “Corp.” designation after a company’s name signifies a level of seriousness, stability, and long-term vision that can be crucial for building trust and confidence among stakeholders.

A clear example of how corporate structure can boost credibility is seen in the technology sector, where companies like Apple and Microsoft have leveraged their corporate status to become global leaders.

Their ability to consistently deliver innovative products, maintain transparency with investors, and uphold ethical standards has solidified their reputations as industry leaders.

In a competitive market, having a corporate structure can serve as a significant differentiator. Customers and partners are more likely to engage with a corporation, perceiving it as more reliable and professional compared to unincorporated businesses.

This perception can translate into increased customer loyalty, better terms with suppliers, and easier access to capital, all of which are crucial for sustained growth.

Additionally, corporations often implement rigorous internal standards for professionalism, including codes of conduct, employee engagement programs, and leadership development initiatives.

For example, companies like Google and IBM have set high standards for workplace professionalism, which in turn enhances their public image and attracts top talent.

5. Tax Advantages

Corporations, particularly C Corporations, benefit from several significant tax advantages that can directly impact their profitability and long-term financial planning.

These advantages include a lower corporate income tax rate, the ability to deduct employee benefits, tax-advantaged retirement plans, and strategic use of carryforward and carryback losses.

The key advantage for C Corporations is the lower corporate income tax rate, which can substantially reduce overall tax liabilities. In 2024, the corporate tax rate continues to be favorable for businesses aiming to reinvest profits into growth and development.

For instance, companies that strategically reinvest the savings from lower tax rates into research, development, or operational expansion can enhance their competitive edge and financial stability.

Additionally, C Corporations can deduct employee benefits such as health insurance, retirement contributions, and other perks, which not only improves employee satisfaction but also reduces taxable income. This strategy is particularly beneficial for businesses looking to attract and retain top talent while maintaining tax efficiency.

Moreover, tax-advantaged retirement plans offer a dual benefit by providing for employees’ future while simultaneously reducing the corporation’s taxable income. These plans allow corporations to contribute pre-tax dollars towards retirement savings, which helps in lowering the overall tax liability.

Another significant advantage is the ability to carry forward and carry back losses. This allows corporations to manage tax liabilities effectively over time, especially during economic fluctuations.

For example, a company that experiences a loss in one year can apply that loss to previous or future years to reduce taxable income, which can provide critical tax relief during tough financial periods.

Downsides of Running a Business as a Corporation

| Downside | Description |

|---|---|

| Complexity and Costs | Forming and maintaining a corporation requires extensive paperwork, regulatory compliance, and higher administrative costs compared to other business structures. |

| Double Taxation | C Corporations face double taxation, where profits are taxed at the corporate level and again when distributed as dividends to shareholders. |

| Regulatory and Compliance Burdens | Corporations are subject to more stringent regulations, requiring regular reporting, annual meetings, and adherence to corporate formalities. |

| Diffused Control | Ownership is spread among shareholders, and decision-making is often handled by a board of directors, which can dilute individual control over the business. |

| Lack of Flexibility in Profit Distribution | Corporations must adhere to rigid structures for profit distribution, which may not align with the owners’ preferences or financial strategies. |

1. Complexity and Costs

One of the major downsides of forming a corporation is the complexity and associated costs involved in both the formation and ongoing maintenance of the corporate structure.

Establishing a corporation requires a significant amount of paperwork, including filing articles of incorporation, creating corporate bylaws, and obtaining necessary licenses and permits.

Additionally, corporations must comply with more stringent regulatory requirements compared to other business structures, such as sole proprietorships or partnerships. These include holding regular board meetings, maintaining detailed records, and filing annual reports.

Operating a corporation in countries with high regulatory demands, such as Greece or Japan, can be particularly challenging. Greece, for example, ranks among the most complex jurisdictions for doing business in 2024 due to its intricate accounting, tax, and HR compliance requirements.

Corporations in such environments face substantial administrative burdens, requiring dedicated resources to manage these obligations effectively.

Furthermore, the ongoing costs of maintaining a corporation, including franchise taxes, legal fees, and compliance costs, can add up quickly, making it a less attractive option for smaller businesses or startups with limited resources.

2. Double Taxation

Double taxation is a significant drawback of forming a corporation, particularly for C Corporations. This occurs because corporate profits are taxed twice: once at the corporate level and again when distributed as dividends to shareholders.

This double layer of taxation can considerably reduce the overall profitability for shareholders and is a major factor for businesses to consider when deciding whether to incorporate.

Imagine a corporation that earns $100 in profit. Initially, the corporation pays a corporate income tax, which, depending on the jurisdiction, might be around 25%. This leaves $75 in after-tax profit.

If this profit is then distributed as dividends to shareholders, those dividends are taxed again at the individual level, potentially at a rate around 29%, depending on the specific tax rates applicable.

After this second round of taxation, the shareholder is left with approximately $53. This means that the total effective tax rate on the original corporate profits could be as high as 47%.

This double taxation can deter investors, especially in environments where pass-through entities like S Corporations or partnerships offer tax advantages by avoiding this additional layer of taxation.

3. Regulatory and Compliance Burdens

One of the most significant challenges corporations face is navigating the complex and ever-evolving landscape of regulatory compliance.

Corporations, especially those operating across multiple jurisdictions, are subject to a wide range of regulations that require meticulous attention to detail, substantial resources, and ongoing monitoring to ensure adherence.

In 2024, corporations across various industries, from manufacturing to finance, are grappling with increasingly stringent regulations.

For instance, the U.S. Department of Labor has introduced new rules requiring high-hazard industries with over 100 employees to submit electronic reports on injury and illness, adding another layer of compliance that companies must manage.

Similarly, the introduction of new data privacy and cybersecurity regulations, particularly in the European Union and the United States, has further intensified the compliance burden.

Moreover, the global push towards Environmental, Social, and Governance (ESG) compliance has added another dimension to corporate obligations.

Companies are now required to assess and report their environmental impact, human rights practices, and corporate governance, not only within their operations but also across their entire supply chains.

This has created significant challenges for companies, particularly those with extensive international operations, as they must now ensure that all third-party partners comply with these standards.

Failure to comply with these regulations can result in heavy fines, legal sanctions, and reputational damage, which can be particularly devastating in industries where trust and compliance are paramount.

For example, data breaches due to inadequate cybersecurity measures can lead to fines that average around $4.45 million per incident, not to mention the long-term impact on customer trust and corporate reputation.

4. Diffused Control

Incorporating as a corporation often results in a diffusion of control, which can be a significant downside for business owners who prefer to maintain tight control over their operations. In a corporate structure, ownership is distributed among shareholders, and decision-making authority is typically delegated to a board of directors.

This separation of ownership and management can lead to conflicts of interest, particularly when the goals of shareholders, directors, and executives diverge.

A notable case that illustrates the challenges of diffused control is the acquisition process involving Columbia Pipeline Group by TransCanada.

During this acquisition, the decision-making process was heavily influenced by the personal interests of key executives rather than the best interests of the shareholders.

The court found that the CEO and CFO of Columbia were more focused on securing their own early retirements, which led to a negotiation process that did not maximize shareholder value.

In another example, Tesla’s acquisition of SolarCity involved a situation where Elon Musk, who had significant influence over both companies, was involved in the negotiation process.

Despite potential conflicts of interest, the board of Tesla managed to maintain an independent stance, conducting thorough due diligence and ultimately securing a deal that was in the best interest of the company.

5. Lack of Flexibility in Profit Distribution

Corporations, especially those structured as C Corporations, often face limitations in how they can distribute profits.

This lack of flexibility can be a significant disadvantage, particularly when compared to other business structures like LLCs. In a corporation, profits are generally distributed as dividends based on the number of shares each shareholder owns.

This rigid structure doesn’t allow for tailored profit distribution that might better reflect the contributions or needs of individual shareholders.

For example, if a company decides to reinvest profits back into the business rather than distribute dividends, shareholders looking for immediate returns may feel disadvantaged.

FAQs

What are the main steps to form a corporation?

Forming a corporation typically involves several key steps:

- Choose a business name and ensure it is unique within your state.

- File Articles of Incorporation with your state’s Secretary of State office, which outlines the basic details of your corporation.

- Create corporate bylaws, which are the rules governing how your corporation will operate.

- Appoint a board of directors to oversee the company.

- Issue stock certificates to initial shareholders.

- Obtain any necessary licenses and permits for your business operations.

- Register for federal and state taxes, including obtaining an EIN (Employer Identification Number) from the IRS.

- Hold the first board meeting to officially launch the corporation.

What does it mean to “pierce the corporate veil”?

“Piercing the corporate veil” refers to a legal decision where courts disregard the corporation’s limited liability protection and hold the shareholders personally liable for the company’s debts or actions.

This typically occurs when a corporation has been used to commit fraud, when corporate formalities have not been properly followed, or when personal and corporate finances are commingled. It’s a reminder of the importance of maintaining proper corporate governance and keeping business and personal activities separate.

What are the ongoing compliance requirements for a corporation?

Corporations are required to follow specific ongoing compliance requirements, which include:

- Holding annual shareholder meetings.

- Keeping minutes of meetings.

- Filing annual reports with the state.

- Maintaining proper financial records.

- Paying required state and federal taxes.

- Adhering to regulations regarding the issuance of stock. Failing to comply with these requirements can result in penalties and the potential loss of corporate status.

Can a corporation change its business structure later on?

Yes, a corporation can change its business structure, but the process can be complex. For example, a corporation might decide to convert to an LLC or change from a C Corporation to an S Corporation.

This often involves legal and tax considerations, such as filing the appropriate documents with the state, obtaining consent from shareholders, and possibly dealing with tax consequences. It’s advisable to consult with legal and tax professionals before making such a change.

What role does a board of directors play in a corporation?

The board of directors is responsible for overseeing the corporation’s management and making major decisions, such as setting company policies, hiring and firing top executives, and approving dividends and major capital expenditures.

The board acts on behalf of the shareholders to ensure that the corporation is run in a way that aligns with the owners’ interests. Directors are typically elected by shareholders and are bound by fiduciary duties to act in the corporation’s best interests.

How does the process of issuing stock work in a corporation?

Issuing stock involves creating shares of the company that represent ownership interests. These shares can be sold to raise capital or given to founders and employees as part of their compensation.

The process typically requires board approval, and the number of shares and their value are determined by the corporation’s bylaws and state regulations. Once issued, these shares can be traded among investors, and the corporation must keep detailed records of who owns them.

Last Words

corporation isn’t something to take lightly. It comes with some solid benefits, like protecting your personal assets and making it easier to raise capital, but it also brings a bunch of challenges.

You’ve got to deal with more paperwork, stricter regulations, and the potential headache of double taxation. Plus, you might lose some control over how profits are distributed and how decisions are made.

If you’re serious about growing your business and ready to handle the extra complexity, a corporation could be the right move. But if you want more flexibility and less red tape, you might want to think twice or explore other business structures.

Either way, make sure you’re clear on what you’re getting into, and consider talking to a financial expert to make sure your choice lines up with your goals.