Welcome to our deep dive into the world of capital markets. In this blog post, we will unpack the fundamental concepts of capital markets, their instruments, the types that exist, and their key functions. So, whether you’re an aspiring investor, a finance student, or simply a curious reader, let’s set off on this enlightening journey together.

An Overview

Capital markets refer to any marketplace where buyers and sellers interact to trade financial securities. These securities include stocks, bonds, and other investment tools that companies and governments use to generate funds. The function of capital markets is crucial in powering economic growth.

They provide a channel for investors to invest their idle savings into profitable ventures, helping businesses finance their operations and growth plans. Moreover, capital markets facilitate the smooth flow of capital across the economy, contributing to wealth creation for investors and economic development.

Role of Capital Markets in an Economy

Capital markets play an essential role in promoting economic growth and development. They offer a platform for investors to make their savings work for them and for businesses to acquire the necessary funding for expansion. Capital markets also ensure the efficient allocation of resources in an economy.

They direct funds from entities with surplus funds to those requiring them, helping the latter invest in productive ventures. This efficient allocation promotes economic productivity and growth. Moreover, capital markets enhance liquidity by providing a platform for buying and selling securities, making investment more attractive and accessible for a larger population.

Capital Market Instruments

Equity

Equity instruments represent an ownership interest in a company. They primarily consist of common stocks. Investors who purchase these stocks become part-owners of the company, entitled to a share of the company’s profits and assets.

When you buy equity shares, you’re essentially buying a small piece of a company. In return, you get voting rights and may receive dividends, which are a portion of the company’s earnings distributed to shareholders. Moreover, as the company grows and becomes more profitable, the value of your shares may increase, potentially leading to capital appreciation.

Debt

Debt instruments are a type of investment where an investor lends money to an entity, which agrees to repay the loan at a later date, typically with interest. These instruments include bonds, debentures, and notes. Investing in debt instruments essentially means you’re lending money to the issuing entity.

In return, you receive interest payments over a defined period and the principal amount upon maturity. While the potential returns may not be as high as with equity instruments, debt instruments tend to be less risky and can provide a steady income stream.

Types of Capital Markets

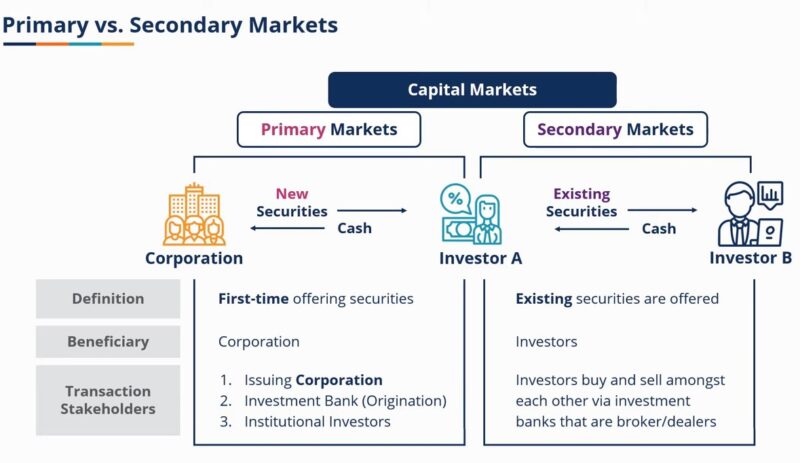

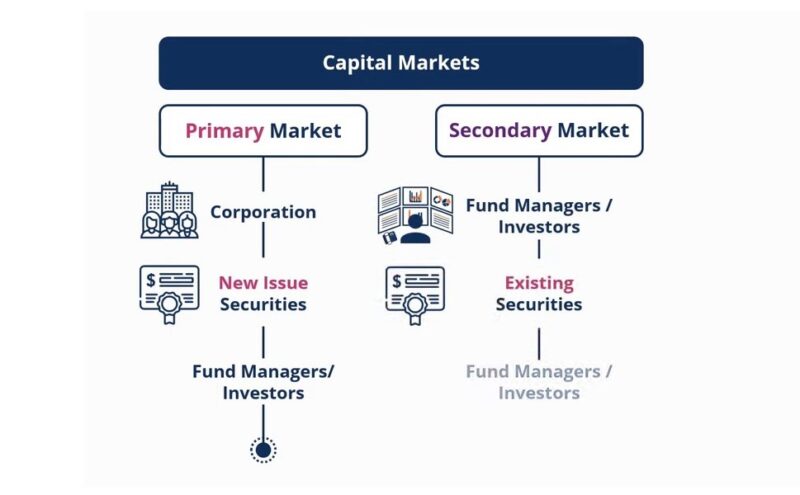

Primary

The primary market, also known as the new issues market, is where new securities are issued and sold for the first time. Companies, governments, and other entities use primary markets to raise new capital. When a company decides to raise funds by issuing new shares, it does so in the primary market.

The company sets an initial price for these shares in what’s known as an Initial Public Offering (IPO). The funds raised through the IPO go directly to the company, allowing it to invest in business operations or pay off existing debt.

Secondary

Once securities have been issued in the primary market, they are subsequently traded in the secondary market. This is where investors buy and sell securities amongst themselves. The secondary market plays a pivotal role in providing liquidity, which is the ease with which an asset can be converted into cash.

When you hear people talking about “the stock market,” they’re usually referring to the secondary market. It allows investors to exit their investment position whenever they want, making an investment in securities a more attractive prospect.

Their Functions

Mobilization and Channelization of Savings

One of the key functions of capital markets is to mobilize savings from investors and channel them into productive investment opportunities.

- They encourage savings by offering investment opportunities.

- They gather these savings from diverse sectors and pool them together.

- Finally, they allocate these pooled funds to companies and governments in need of capital.

In doing so, capital markets help transform individual savings into productive investments, fueling economic growth.

Determination of Price

Capital markets also play a crucial role in determining the price of securities. The price of any security traded in the market is set by the forces of supply and demand.

- If the demand for security is high, the price will increase.

- Conversely, if the supply of a security exceeds its demand, the price will fall.

This price mechanism plays an essential role in allocating resources in an economy. It ensures that funds are directed towards companies that are likely to use them most efficiently, as reflected by their higher market value.

Participants in Capital Markets

Issuers

Issuers are the entities that raise capital by selling securities in the capital markets. They can be corporations, governments, or other organizations that need funds for various purposes, like expanding their operations or funding public projects.

Issuers leverage the capital market to turn their funding needs into investment opportunities for investors. In return for the funds they receive, they offer a claim on their future earnings (in the case of equity) or a promise to repay with interest (in the case of debt).

Investors

Investors are individuals, corporations, or institutional investors who purchase securities in the capital markets. They do so with the hope that the securities will provide returns in the form of dividends or interest or appreciation in value over time. Investors are key to the functioning of the capital market.

They supply the funds that issuers need, and in return, they seek to grow their wealth. The level of risk they are willing to take, and their expectation of returns greatly influence the pricing of securities in the market.

Intermediaries

Broker-Dealers

Broker dealers play a critical role in the functioning of capital markets. They act as intermediaries between buyers and sellers of securities. Brokers execute trades on behalf of their clients, while dealers trade securities on their own accounts.

Broker-dealers enhance market liquidity by constantly buying and selling securities, ensuring that investors can enter or exit their investment positions whenever they wish. They also help investors make informed investment decisions by providing research and investment advice.

Investment Banks

Investment banks serve as intermediaries between issuers of securities and the investing public. They play a vital role in the issuance process of new securities in the primary market. Investment banks assist issuers in determining the type and features of securities to be issued, pricing them accurately, and marketing them to potential investors.

Additionally, they often underwrite the issue, which means they guarantee the sale of the issued securities by agreeing to buy any that are not purchased by investors.

Efficiency

Efficient Market Hypothesis

The Efficient Market Hypothesis (EMH) is a theory that suggests that all relevant information about a security is fully and immediately reflected in its market price. Therefore, it posits that it’s impossible to consistently achieve higher-than-average returns in the market by buying undervalued securities or selling overvalued ones, given the risk.

According to EMH, markets are always in equilibrium, and it’s impossible to ‘beat the market’ without taking on more risk or having access to insider information. This hypothesis has significant implications for investors and their investment strategies.

Market Anomalies

Despite the prevalence of the EMH, there exist instances known as market anomalies that seem to contradict this theory. These are patterns of returns that appear to deviate from the norm and offer potential opportunities for abnormal returns.

Some examples of market anomalies include the January effect (stocks performing better in January than in other months), the Monday effect (stocks performing poorly on Mondays), and the momentum effect (stocks with high returns in the past continuing to perform well). Understanding these anomalies can offer potential opportunities for investors, albeit often accompanied by higher risk.

Regulations

Importance of Regulations

Regulations play a critical role in ensuring the smooth functioning of capital markets. They aim to protect investors, maintain fair and transparent markets, and facilitate capital formation.

Regulations seek to promote transparency by requiring issuers to disclose accurate and timely information about their financial health and performance. They also aim to protect investors by ensuring that securities are not mispriced and by preventing fraudulent activities.

Regulatory Bodies

In the United States, the main regulatory body overseeing capital markets is the Securities and Exchange Commission (SEC). The SEC enforces securities laws, promotes full public disclosure, protects investors against fraudulent practices, and oversees all key participants in the securities world, including stock exchanges, broker-dealers, investment advisors, and mutual funds.

In the United Kingdom, the Financial Conduct Authority (FCA) plays a similar role. These bodies ensure that the capital market operates efficiently and fairly, fostering investor confidence and promoting economic growth.

FAQs

What are the Types of Capital Market?

The two primary types are the primary and the secondary market. The primary one deals with new securities issues, also known as Initial Public Offer (IPO). The secondary one, also known as the stock market, is where trading occurs for existing securities.

What are the Instruments Traded in the Capital Market?

In the capital market, five types of instruments are traded: equities (equity shares and preference shares), debt securities (bonds and debentures), derivatives (forwards, futures, options, interest rate swaps), exchange-traded funds, and foreign exchange instruments.

What is the difference between the money market and the capital market?

Money markets are used for short-term borrowing of assets held for less than a year or a year. On the other hand, capital markets are used for long-term securities that indirectly or directly impact the capital.

How to learn about the capital market?

You can learn about it through online platforms or courses.

How are bonds different from debentures?

The issuer’s collateral or asset backs bonds, but debentures are not backed by collateral or physical assets.

Are capital markets efficient?

Similar to most markets, the capital kind is not perfectly efficient. However, the prices of securities reflect they have incorporated the present information available in the market.

Final Words

By providing a platform for raising capital and trading securities, capital markets serve as a vital cog in the wheel of economic development. They enhance resource allocation, offer investment opportunities, foster economic growth, and facilitate wealth creation.

Understanding how capital markets work can therefore offer valuable insights into the broader economic landscape, helping us make informed financial decisions.